Introduction

For many people, buying a house is a significant milestone in life, representing financial stability and a place to call home. However, securing a mortgage to buy a house requires a careful assessment of your financial history and creditworthiness. Your credit plays a pivotal role in this process. In this article, we will explore what credit score is needed to buy a house and how it impacts your ability to obtain a mortgage. Explore what credit score is needed to buy a house. Explore mortgage credit scores, learn how to boost your score for a better mortgage deal, and FAQs on credit.

Understanding the Mortgage Credit Score

A mortgage credit score is a three digit number that represents your credit worthiness based on your credit score history. This score is different from the regular credit scores you might be familiar with, such as FICO or VantageScore. While those scores are used by various creditors, the mortgage credit score is specifically tailored for the mortgage industry.

Lenders use a range of credit scoring models, but the most common one is FICO score, which ranges from 300 to 850. Generally, the higher your credit score, the more likely you are to qualify for a mortgage and receive favorable interest rates. Several factors affect your mortgage credit score, including payment history, credit utilization, length of credit score history, types of credit used, and recent mortgage applications for new credit.

Mortgage Credit Score

A mortgage credit score, often referred to as a “housing credit score,” is a specific credit score used by lenders when considering your application for a home loan. This score helps lenders assess the risk associated with lending you a substantial amount of money for a mortgage. While the principles of how credit scores are calculated remain the same, mortgage credit scores might be slightly different from other types of credit scores, as they can place a greater emphasis on factors relevant to home financing.

Credit Score Ranges

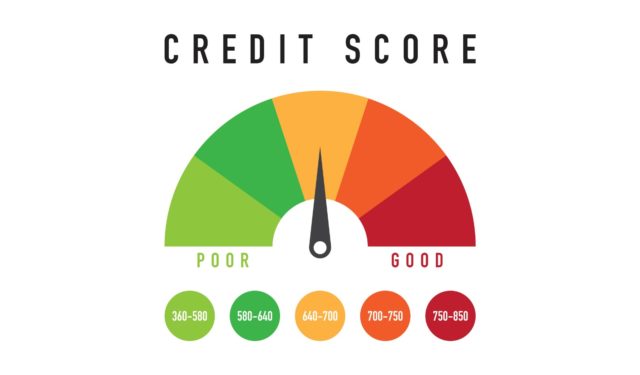

Credit scores typically fall within a range, with higher scores indicating better creditworthiness. The specific credit score range required to buy a home can vary depending on the type of mortgage and the lender’s requirements. However, here is a general overview of credit score ranges:

- Poor (300-579): Individuals with credit scores in this range may find it challenging to qualify for a mortgage. If they do, they are likely to face higher mortgage interest rates and stricter terms due to the increased risk associated with low credit scores.

- Fair (580-669): Credit scores in this range may make it possible to secure a mortgage, but it might still be challenging. Interest rates and down payment requirements are likely to be higher compared to those with better credit scores.

- Good (670-739): This credit score range is considered to be decent, and it should make it easier to qualify for a mortgage with reasonable terms and interest rates.

- Very Good (740-799): Individuals with credit scores in this range are more likely to obtain favorable mortgage offers, including lower interest rates and down payment requirements.

- Excellent (800-850): The highest credit score range, which greatly increases your chances of securing a mortgage with the best terms and the lowest interest rates.

Minimum Credit Score for a Mortgage

While there is no universally set minimum credit score required to buy a house, mortgage lenders typically have specific guidelines and preferences. The exact credit score requirement can vary among lenders and even among different types of mortgages, such as conventional loans, FHA loans, VA loans, and USDA loans. Let’s take a closer look at these types and their typical credit score requirements:

- Conventional Loans: These are traditional mortgages not backed by the government. Many lenders prefer a credit score of 620 or higher for conventional loans. However, to secure the best interest rates and terms, you may need a score closer to 740 or above.

- FHA Loans: The Federal Housing Administration insures FHA loans, making them more accessible to home buyers with lower credit scores. Many FHA lenders accept credit scores as low as 500 to 580 with a higher down payment, while a score of 580 or higher might qualify for a down payment as low as 3.5%.

- VA Loans: For military veterans and active-duty service members, the U.S. Department of Veterans Affairs (VA) offers VA loans with flexible credit score requirements. While there is no strict minimum, most lenders prefer scores of 620 or higher.

- USDA Loans: The U.S. Department of Agriculture (USDA) offers loans for eligible rural and suburban homebuyers. Credit score requirements vary by mortgage lender but typically range from 640 to 680 or higher.

Keep in mind that even if you meet the minimum credit score requirements, other factors will influence your mortgage application’s success. These factors include your income, debt-to-income ratio, employment history, and the size of your down payment.

Improving Your Credit Score for Homebuying

If your credit score falls below the desired range for the type of mortgage you want, there are several steps you can take to improve it:

- Review Your Credit Report: Obtain a free copy of your credit report and review it for errors or inaccuracies. Dispute any discrepancies with the credit reporting agencies to ensure your credit history is as accurate as possible.

- Pay Your Bills on Time: Consistently paying all your bills on time is one of the effective ways to boost your credit score.

- Reduce Outstanding Debt: Lowering your credit card balances and paying off high-interest loans can positively impact your credit score.

- Avoid Opening New Credit Accounts: Each new credit inquiry can temporarily lower your credit score. Avoid opening too many new credit accounts in the months leading up to your mortgage application.

- Work with a Credit Counselor: If you’re struggling to improve your credit on your own, consider working with a credit score counselor who can provide guidance and strategies for raising your score.

Essential Minimum Credit Scores for Homebuyers

The minimum credit required to buy a house can depend on the type of mortgage loan you’re seeking. However, in most cases, lenders look for a minimum credit score of 620 or higher. This benchmark ensures that borrowers have a reasonably good credit history and are less likely to default on their loans.

For some government-backed loans, such as those insured by the Federal Housing Administration, the minimum credit score requirement may be lower, typically around 580. However, a lower credit score might result in higher interest rates and stricter lending terms. It’s important to note that meeting the minimum credit score requirement doesn’t guarantee loan approval; lenders also consider other factors like income, employment history, and debt-to-income ratio.

Understanding the significance of your mortgage credit score is crucial when embarking on the journey of homeownership. Aspiring homebuyers should aim for a credit score of 620 or higher to increase their chances of securing a mortgage with favorable terms. However, it’s essential to note that the minimum credit requirement can vary depending on the type of loan and the lender’s specific criteria. By maintaining a good credit history, managing debts responsibly, and staying informed about your credit score, you can pave the way toward your dream of owning a home.

Conclusion

Your credit is a crucial factor when buying a house and securing a mortgage. While there is no one-size-fits-all credit score requirement, it’s essential to have a good understanding of the typical credit score ranges for different types of mortgages. By working to improve your credit and managing your finances responsibly, you can increase your chances of obtaining a mortgage with favorable terms and realizing your dream of homeownership. Remember that consulting with a qualified mortgage lender or financial advisor is a wise step to ensure you are on the right track toward buying your home.

Frequently Asked Questions (FAQs):

1. Can I buy a home with poor credit?

- While it’s possible to buy a house with bad credit, it can be more challenging. You may need to consider government-backed loans, work on improving your credit, or explore alternative options.

2. What’s the minimum credit score needed to buy a house?

- The minimum credit varies depending on the type of mortgage. For conventional loans, a score of 620 or higher is often required, while government-backed loans like FHA may accept scores as low as 500 to 580 with specific conditions.

3. How can I improve my credit for homebuying?

- To improve your credit score, pay all bills on time, reduce outstanding debt, review and dispute errors on your credit report, and avoid opening too many credit accounts before applying for a mortgage.

4. Can a cosigner help with a low credit score?

- Having a cosigner with a better credit score may help you qualify for a mortgage or secure better terms, but it’s important to recognize that your cosigner is equally responsible for the loan, and their credit can be impacted.

5. What if I don’t have a credit history?

- If you lack a credit history, you might still be able to get a mortgage by using alternative credit data or demonstrating a history of responsible financial behavior, such as paying rent and utilities on time.

6. Is there an ideal credit score for the best mortgage terms?

- While there isn’t a single ideal credit, having a credit in the “very good” or “excellent” range (typically 740 or higher) can help you qualify for the best mortgage terms, including the lowest interest rates.

7. What factors affect my credit score?

- Your credit score is influenced by many factors, including payment history, credit utilization, length of credit score history, types of credit accounts, and recent credit inquiries.

8. Can I get a mortgage with a co-borrower?

- Yes, you can apply for a new mortgage with a co-borrower, which can be a spouse, family member, or another person. This can help if one borrower has a stronger credit profile.

9. How often should I check my credit score before applying for a mortgage?

- It’s advisable to regularly monitor your credit score and check your credit report for errors. Ideally, start this process at least a year before applying for a mortgage to ensure you have time to make improvements if needed.

10. What should I do if I find errors on my credit report?

- If you discover errors on your credit score report, you should promptly dispute them with the credit reporting agencies. Correcting inaccuracies can help improve your credit score.

11. Can I get a mortgage with a previous bankruptcy or foreclosure on my credit history?

- It is possible to get a mortgage after bankruptcy or foreclosure, but you may need to wait a certain period and demonstrate responsible financial behavior after these events. The waiting periods vary depending on the type of your mortgage and the circumstances of the bankruptcy or foreclosure.

12. How does my debt-to-income ratio affect my ability to get a mortgage?

- Lenders consider your debt to income ratio (DTI) when assessing your mortgage application. A lower DTI, which means you have less debt relative to your income, can improve your chances of approval and better loan terms.

13. Can I get a mortgage if I have student loan debt?

- Yes, you can still qualify for a mortgage if you have student loan debt. However, the amount of your student loan debt and your ability to manage it will affect your eligibility and the terms of your mortgage.

14. Does a pre-approval guarantee a mortgage?

- A mortgage pre-approval is not a guarantee of a mortgage loan but is a strong indicator of your eligibility. The final approval is contingent on the property’s appraisal and other factors.

15. Can I refinance my mortgage to get better terms with a lower credit score than when I initially bought the house?

- Refinancing your mortgage may be an option to obtain better terms, even if your credit score has decreased since you first bought the house. However, a lower credit score might result in less favorable terms compared to what you might have achieved with a higher score.

Visit RateChecker to get free mortgage quotes!