If there is one thing that all people having a mortgage want, it is to get rid of it soon and start a life without having the burden of paying a debt. Indeed, it is not that easy to do, but you can always rely on us to guide you with the best possible chances of doing it as fast as you can. If you pay off mortgage early than expected then it can help you with financial stability and will help you save money in the long term by accruing less interest. Because mortgages tend to be large loans that last for a couple of decades or even longer, paying them off early can save you tens of thousands of dollars in the name of interest.

How to pay off your mortgage early? This guide will answer this question and help you fully own your house within a short period. Also, we have mentioned 7 ways to pay off your mortgage loan and some tips that will help you through the loan’s lifetime.

What Is a Mortgage?

Firstly, let’s learn what a mortgage is. Mortgages are also called “mortgage loans”, and are the most common way to buy a house in the US without having all the needed cash. It is a type of loan through which you buy homes, land, and other real estate.

The borrower, who wishes to buy a house, agrees to pay the lender a fraction of the loan in installments over a specific time. The borrower is obliged to pay an interest rate as well. In a mortgage, the house itself is the collateral for the loan. Your mortgage rates also depend on your qualification and the nature of the product.

Can You Pay a Home Mortgage Loan Early?

Since mortgages are usually large loans that last for decades or longer, repaying the loan earlier can save you thousands of dollars in interest.

When you send your monthly check to the mortgage lending company, the lender divides the payment into principal and interest. Therefore, in the beginning, the loan payment is used as interest while the remaining installments are paid as the principal. This process is referred to as amortization because it allows the lender to get most of the funds back in the first few years of the agreement.

7 simple ways to pay off your mortgage early

Here we have seven amazing ways to help you pay off mortgage early then you can fathom.

1. Overpay Mortgage

One of the easiest and most successful ways to pay off mortgage early is to make overpayments on your mortgage. Simply, you just have to pay an amount greater than the usual monthly payment. Suppose you have to pay around $900 on the current mortgage, due in 30 years. If you pay up to $990 each month extra, there is a strong likelihood you’ll end up clearing the entire mortgage in much less time.

Furthermore, make sure to instruct your lender to fixate the extra amount on the principal amount. In this way, your debt value will reduce over time.

2. Shorten Term

If you have a relatively long-term mortgage, for say, 20-30 years, the initial year payment counts more towards the interest payment and less on the principal. Besides signing up for a traditional 30-year mortgage, you can go for a 15-year term. The benefit is that you will save a lot of money on interest payments.

Secondly, sometimes you can even qualify for a relatively low rate on a low-term mortgage. While the payment is more than a 30-year term, the difference is not so significant. It’s manageable, and if you strive hard for it, you’ll likely meet the standard monthly payments for a 15-year term mortgage.

3. Refinance

One of the most plausible ways to clear off your mortgage is to go for refinancing. Suppose you start with a traditional 30-year mortgage initially. However, you can always refinance and take out a loan at a lower mortgage rate than the current rate because rates fluctuate daily.

As you can meet high payments, you can move forward and refinance your loan to a lower-term mortgage at a low prevailing rate. Or you may decrease or “shave off” some years each time you refinance. The benefit is that while monthly payments may increase by a minor amount, you’ll still likely save tons of costs in interest payments.

Plus, you’ll decrease the term length over time and may clear your mortgage obligation in as little as 14 years.

4. Mortgage Recasting

This is another method that can help you in paying off your mortgage early. In a recasting situation, you pay a lump-sum amount for your mortgage, which reduces your loan’s pay-off schedule and shows a new balance. As a result, the lump-sum payment will likely reduce your mortgage term length.

Plus, the recasting fees are nominal, and the process isn’t very costly. In contrast, mortgage refinancing can have a high processing fee, which can take a toll on your bank balance.

5. Try a $1/month plan

The dollar-a-month strategy should be financially viable if your income increases gradually.

Add $1 to your monthly payment. Just pay $900 the first month, $901 the second, $902 the third, etc. For a $150,000 loan with a $900-per-month mortgage and a fixed interest rate of 6%, the mortgage term could be cut by eight years.

6. Make use of any unexpected funds.

Send any extra money you get right away to your mortgage company. This includes tax returns, rewards from credit cards, and bonuses for the holidays. Using this money will not affect your monthly budget.

7. Downsize:

Consider downsizing your house. It would be a strong step that would drastically help you in paying off your mortgage faster. You could sell your bigger house and use profits to buy a smaller house. This whole plan would crush your mortgage extremely fast!

The profits from the bigger house would aid you in buying a smaller house completely. But even if you still have got a small mortgage, you can conveniently pay it off within a short period. It is because having a smaller goal is naturally easier to fulfill.

Don’t Buy A Second Home If You Can’t Afford

Let’s say you decide to downsize. Before you buy a second home, you should ensure everything is in order and know how much house you can afford. This handy list of things to do is an excellent place to start. If you can’t answer “yes” to all six questions, you should probably put off buying a home.

- Do I have an emergency fund for three to six months’ worth of expenses?

- Can I make a down payment of at least 10% (preferably 20%)?

- Do I have sufficient funds to cover moving expenses and closing costs?

- Does my house payment take up less than 25% of my monthly income?

- Can I pay for a 15-year loan with a fixed rate?

- Can I afford to keep this house in good shape and pay for the utilities?

Use our mortgage calculator if you need help figuring out how much your new mortgage payment will be each month.

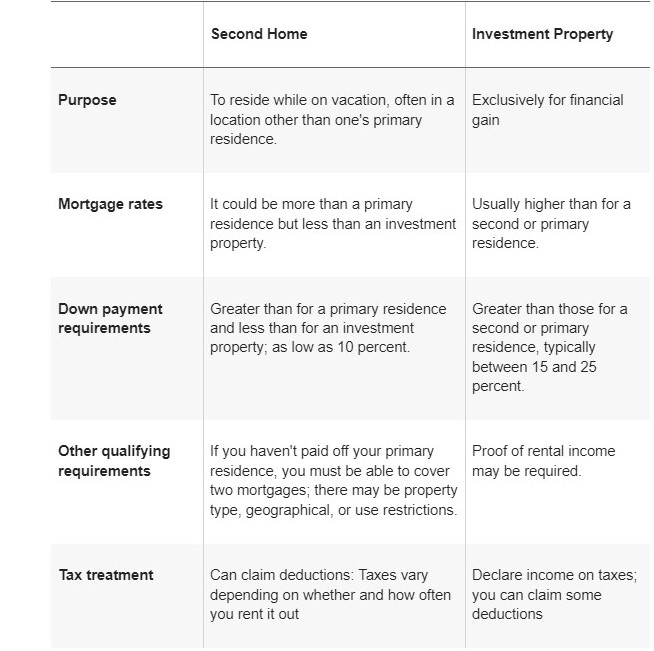

Furthermore, Second homes and investment properties are different, despite their appearances. Choosing the type of property you want to buy is an important first step. Choosing a vacation home or investment property affects mortgage rates, down payments, and tax deductions. Let’s compare second homes and investment properties to see which is best for you.

Second Homes Vs. Investment Properties

Let’s compare Second homes vs. investment properties:

Pay Off Mortgage Faster: Benefits

Paying off a mortgage faster is a better long-term investment than saving money. Let’s find out some advantages of mortgage.

For starters, paying off one debt means you can handle debts like a credit card that are due quickly. Moreover, early mortgage payoff saves money on interest. Getting rid of these future payments improves your financial stability and allows you to handle market fluctuations better.

Final Verdict:

Who wouldn’t love to pay off mortgage early, reduce their burden, and enjoy their life without any worries? Therefore, if you’re always thinking of ways to pay off your mortgage early, you first have to create a budget and strategize it to clear off your debt. Obviously, it requires some sacrifices, but it’s better for the foreseeable future. Nonetheless, if you’re looking for a mortgage for a home purchase or refinancing, you can check out Rate Checker. Visit our website to check out our numerous mortgage services and offerings.

Generated with WriterX.ai — best AI tools for content creation